Canadian Prime Minister Mark Carney's Davos warning was blunt: we are entering a new world order "in the midst of a rupture." For multinational executives, this isn't abstract geopolitics—it's a planning crisis. How do you allocate capital, structure supply chains, and enter markets when the post-WWII framework that made cross-border commerce predictable is fracturing in real time?

Trump's rambling Davos address and his public dismissal of Carney crystalized the problem: mid-tier nations—Japan, Germany, Canada, South Korea, Australia, and others—are being forced to choose sides between the US and China. These aren't ideological choices. They're commercial decisions that will reshape trade flows, technology standards, and regulatory environments for a generation.

Trump's Davos performance reminded me of the Midwest business leaders I grew up around—the type who return from London with a Burberry scarf from Harrods and a conviction they know how to run the planet. The rhetoric is familiar: "You'd be speaking German without us," and "Canada wouldn't exist without us."

These statements might be historically defensible, but they reveal a psychological pattern that matters for business planning: American oscillation between global engagement and continental withdrawal.

Robert Kagan—Brookings senior fellow and former State Department official—has spent decades analyzing this pattern. In his 2021 Foreign Affairs essay and his book The World America Made, Kagan identifies what he calls America's core strategic problem: "Their capacity for global power exceeds their perception of their proper place and role in the world."

Unlike China (seeking to recover past greatness) or Russia (nostalgic for superpower status), Americans have never internalized their global role as permanent. Even after defeating Nazism, Soviet communism, and radical Islamist terrorism, most Americans view international engagement as exceptional rather than normal.

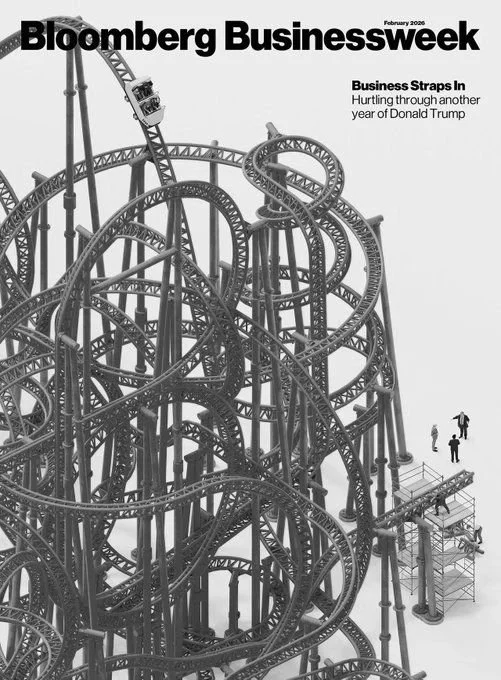

The result, Kagan writes, is "a century of wild oscillations—indifference followed by panic, mobilization and intervention followed by retreat and retrenchment."

For executives navigating transatlantic and transpacific strategy, this oscillation is the risk variable. It's why calling Afghanistan and Iraq "forever wars" matters—it signals American intolerance for the "messy, unending business of preserving a general peace."

Kagan argues that this on-again, off-again approach "has confused and misled allies and adversaries alike, often sparking conflicts that a steady application of American power and influence in service of a peaceful, stable, liberal world order could have avoided."

For business leaders, the question isn't whether America should be a reliable hegemon—it's whether America will be predictable enough to build long-term strategies around.

Carney's speech suggests allied governments are no longer confident in the answer. When Canada's prime minister urges mid-tier nations to "band together" and Trump refuses to meet with him, that's not diplomatic theater—it's a signal that traditional alliance frameworks are no longer reliable guardrails for commercial planning.

Companies with significant cross-border exposure face three immediate planning challenges:

1. Alliance reliability as a supply chain variable: If US security commitments become transactional or unpredictable, allied nations will diversify away from US-dependent systems. This affects everything from semiconductor supply chains to defense procurement to technology standards. Scenario plan for reduced US-allied coordination.

2. The mid-tier nation dilemma: When countries like South Korea, Australia, or Germany are forced to choose between US and Chinese economic orbits, they won't choose ideology—they'll choose commercial pragmatism. Map your exposure to markets facing this binary choice and develop strategies for both scenarios.

3. Institutional breakdown risk: Kagan warns that declining US leadership leads to "global instability, renewed great-power conflict, and the breakdown of vital international institutions." For multinationals, this means the WTO, international arbitration systems, and multilateral agreements may lose enforcement power. Build redundancy into governance frameworks.

The Kagan framework suggests this isn't a Trump phenomenon—it's an American psychology that predates and will outlast any single administration. That has planning implications:

+ Stop planning for policy clarity; plan for policy volatility. Build flexibility into capital allocation decisions that assume US oscillation between engagement and withdrawal.

+ Develop direct government engagement channels in key allied markets that don't depend on Washington coordination. If Carney is urging mid-tier nations to band together, your government affairs strategy should reflect that emerging architecture.

+ Treat US power as a declining variable, not a constant. Kagan argues the post-WWII order "depends on US power, not just American ideals." If that power becomes unreliable or internally focused, the order changes. Stress-test your strategies against scenarios where US economic and security commitments are transactional rather than foundational.

As for the recovery question, can America recover from what I view as a self-inflicted wound?

I believe yes, but Kagan's point is that American psychology makes sustained global leadership unnatural for most US citizens. The twentieth century, he notes, "was littered with the carcasses of foreign leaders and governments that misjudged the United States."

For executives, the lesson isn't to bet against American power—it's to stop assuming American consistency.

The unprecedented peace and prosperity of the post-WWII era represents a unique achievement in human history. But as Carney warned, we're now in the rupture. Your planning frameworks need to reflect that new reality.

Bottom line: Build strategies that can succeed whether America remains globally engaged or retreats into continental psychology. The oscillation itself is the constant.

-Marc

*****

Marc A. Ross is a geopolitical strategist and communications advisor. He is the founder of Caracal Global and is writing a book entitled Globalization and American Politics: How International Economics Redefined American Foreign Policy and Domestic Politics.